Bestselling author and financial guru Robert Kiyosaki explains the real problems plaguing our education system, the shocking truth about our financial system, and the secrets to becoming a successful entrepreneur.

The Real Problem with Traditional Education

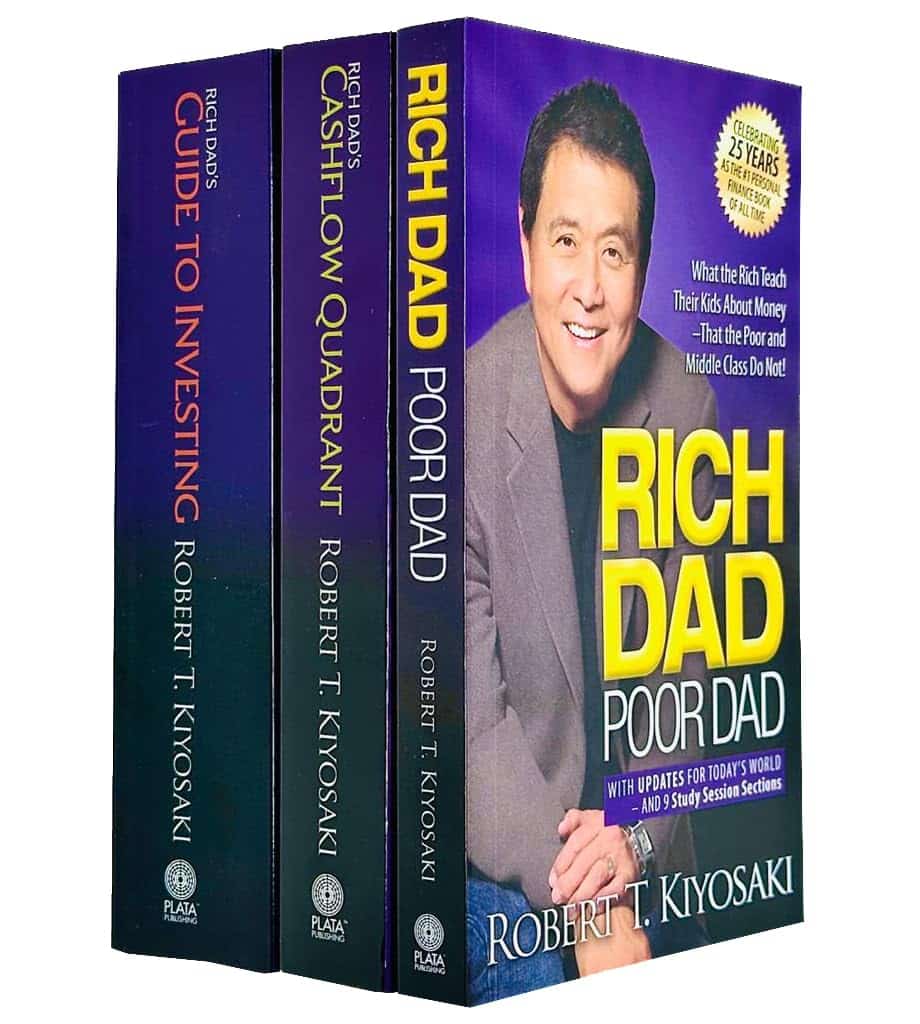

Robert Kiyosaki exposes the weaknesses of traditional education, emphasizing how it fails to provide essential knowledge about money. In his iconic book Rich Dad Poor Dad, he shares the eye-opening story of a boy who learns about financial intelligence from his friend’s rich dad, challenging the traditional script of education, job, and retirement.

Escaping the Rat Race

Robert Kiyosaki presents an alternative path to achieving financial independence and escaping the rat race. He advises aspiring entrepreneurs to build a business on the side while maintaining the safety of their jobs. By investing in income-generating assets, they can eventually rely on these assets as their main source of income, breaking free from the traditional script and achieving financial freedom.

Distinguishing Assets from Liabilities

One of the common misconceptions Kiyosaki addresses is the confusion between assets and liabilities. He clarifies that true assets are sources of income, while liabilities require our financial resources. By understanding this distinction, individuals can make informed financial decisions, avoiding common pitfalls such as considering their primary residence as an asset when it may actually be a liability.

The Cash Flow Quadrant

Building upon his renowned work, “The Cash Flow Quadrant,” Kiyosaki explains the four main quadrants of income generation: Employees (E), Self-Employed/Professionals (S), Business Owners (B), and Investors (I). He emphasizes the importance of transitioning from the left side of the quadrant (E and S), where one trades time for money, to the right side (B and I), where money and other people’s time can be leveraged for financial freedom.

The Challenge of Selling

According to Kiyosaki, the biggest challenge faced by aspiring entrepreneurs is their inability to sell. Drawing from his own experience, he highlights the importance of resilience and the ability to handle rejection. He encourages individuals to embrace failure as a learning opportunity and emphasizes the necessity of developing a sales mindset to thrive as an entrepreneur.

The Truth Behind Fake Money and Fake Teachers

Kiyosaki boldly exposes the flaws within our current financial system, calling it “fake money.” He criticises the education system as being corrupt, bankrupt, and out of touch with reality, referring to it as “fake teachers.” He also highlights the risks associated with relying on Wall Street for investment opportunities, urging individuals to be aware and make informed decisions.

Conclusion

Robert Kiyosaki’s interview offers a thought-provoking exploration of the flaws within our education and financial systems. By challenging commonly-held beliefs and offering alternative perspectives, he empowers aspiring entrepreneurs to break free from the traditional script and embrace financial intelligence. Are you ready to challenge the status quo and embark on a path to financial freedom?

EPISODE QUICK Q&A

Q: What is the main message Robert Kiyosaki wants to convey about traditional education in his book “Rich Dad Poor Dad”? Robert Kiyosaki exposes the weaknesses of traditional education, emphasizing how it fails to provide essential knowledge about money. He believes that following the traditional script of education, job, and retirement can harm one’s financial well-being.

Q: How can individuals escape the rat race and achieve financial independence, according to Robert Kiyosaki? Kiyosaki advises individuals to build a business on the side while maintaining the safety of their jobs. By investing in income-generating assets and gradually shifting their reliance from a job to their assets, they can escape the rat race and achieve financial independence.

Q: What is the key distinction between assets and liabilities, according to Robert Kiyosaki? Kiyosaki clarifies that assets are sources of income, while liabilities require our financial resources. For example, a primary residence may not be considered an asset unless it produces income. Understanding this distinction is crucial for making informed financial decisions.

Q: What are the four main quadrants of income generation in Robert Kiyosaki’s Cash Flow Quadrant? The four quadrants are Employees (E), Self-Employed/Professionals (S), Business Owners (B), and Investors (I). Moving from the left side (E and S), where time is traded for money, to the right side (B and I), where money and others’ time can be leveraged, is key to achieving financial freedom.

Q: What is the biggest challenge faced by aspiring entrepreneurs, according to Robert Kiyosaki? Kiyosaki believes that the biggest challenge for aspiring entrepreneurs is their inability to sell. He emphasizes the importance of resilience and the ability to handle rejection, highlighting that learning from failure is crucial for entrepreneurial success.

Q: How does Robert Kiyosaki view the current financial system and education system? Kiyosaki strongly criticizes the current financial system, describing it as “fake money.” He also critiques the education system, referring to it as “fake teachers” and claiming that it is corrupt, bankrupt, and out of touch. He urges individuals to be aware and make informed decisions in a system that he believes is designed to rip people off.

Robert Kiyosaki Classic Collection