What is Rent to Rent?

You may have heard about this new opportunity to get on the property ladder without a big fat deposit or paying exorbitant stamp duty charges, but Rent-to-Rent is not all sunshine and rainbows

In this article, I will share with you everything you need to know to make an educated decision about starting a Rent-to-Rent business in the UK. So, let's begin by defining what Rent-to-Rent is:

Rent to Rent, also known in the UK as Guaranteed Rent, is where an individual or company, "The Renter", guarantees rents to a property owner for an agreed period of time to manage the property and sublets it to third parties. The difference between the Rent paid and the Rent received is the Renter's profit before expenses.

Nelson Rockefeller famously said, "The secret to success is to own nothing, but control everything.

The concept of Rent-to-Rent is simple, and many people are deceived into believing it's an easy business to run. However, this is further from the truth. Running a Rent-to-Rent business is time-consuming, and you need to be an enthusiastic problem solver - especially at the beginning of your journey. Keep reading, and you will understand the pros and cons of Rent to Rent in the UK and if this business model is something you'd like to pursue.

Is Rent to Rent A Good Investment Strategy In The UK ?

Rent-to-Rent is more a business than a property investment strategy. Many people invest in property to create passive income, secure a comfortable retirement or leave a legacy. In Rent-to-Rent, especially at the beginning, there is no "passive" because you are starting a property management business to help property investors and property owners to have a hands-free investment experience - while you do all the work!

What are the different Rent-to-Rent Business Models?

Now, imagine Rent-to-Rent as an umbrella. Under this umbrella, you have three Rent-to-Rent models, each of which has pros and cons. The most common are the Rent-to-Rent House in Multiple Occupation (HMO) and Rent-to-Rent Service Accommodation (SA) because they are more profitable than managing a Single Let unit. However, more work is involved, so you have to choose the best model for you and your area.

Let's go through the three different Rent-to-Rent models:

1. Rent-to-Rent House in Multiple Occupation (HMO)

What is a House in Multiple Occupation (HMO)?

A house in multiple occupations (HMO) is a property rented out by at least three people who are not from the same household (not from the same family) but share facilities like the bathroom and kitchen. In the UK, it's sometimes called a 'house share', and you need a license to run it. The license must be renewed max every 5 years.

Some great websites to check for more resources:

2. Rent-to-Rent Service Accommodation (SA)

What is Service Accommodation (SA)?

Serviced accommodation refers to facilities that provide the same features and utilities as hotels - PLUS the extra comfort of staying on your own in a homey environment. Usually, short and long terms lets are available to the guests on a license agreement bases.

3. Rent-to-Rent Single Let

What is a Single Let?

Single Let refers to a house or an apartment that lets out on a single "tenancy" agreement. The occupier or occupiers could be an individual, a couple, or a family under the same tenancy agreement.

If you want to make at least £500/pcm (per calendar month) on a rent-to-rent unit, then single let may not be a suitable choice because the profit margins are too tight, if any. That's why most Rent-to-Rent operator takes on board single let units only if the property owner has a portfolio that includes it.

How Much Can I Make With Rent to Rent In The UK?

As a rule of thumb, you want to make at least £500/pcm per property you manage - which is net after expenses. You only need a handful of Rent-to-Rent properties to match the median annual salary in the UK, which in 2021 was £31,285* (data published on statista.com)

There are many examples of Rent-to-Rent operators making over a million pounds in revenue with this business model, and even companies like Premiere Inn partially use this strategy. Rent-to-Rent is very attractive because once you have the right systems and a reliable team in place, scaling your Rent-to-Rent business is just a number game.

Let's go deeper into the Rent-to-Rent business model. You could consider the Rent-to-Rent business as a hybrid business model between a traditional letting agency and a property management company. One of the cons is that you may bear more risks than a traditional letting agency but also have the opportunity to make more profits.

So, you should really ask yourself what your risk appetite is. What's the ratio between risk and reward you are comfortable with, and how fast do you want to get your money out of the deal? These are the basics of investing and apply to Rent-to-Rent too.

We will discuss the risks involved with this business model shortly, but for now, I just want to emphasise that in any business, there are risks involved, and Rent-to-Rent is not an exception. So, can you make a lot of profits, yes! Can you also lose money? Yes!

It's all about knowing your area and your numbers and protecting the downside. Let's go through some Rent-to-Rent deals together, and I will break down the figures for you to better understand what to look for when finding a Rent-to-Rent deal.

Rent-to-Rent Case Study (Complete Breakdown)

Now, you find a three bedrooms - all en-suites - victorian house with two receptions. Let's say that after conducting your due diligence, you find that in your area, a three beds house goes for £1500/pcm.

(DISCLAIMER) For the sake of this example, we will assume that the property is suitable for service accommodation or a house in multiple occupation (HMO), and your decision to go with one or the other model is based on your market research. Also, we won't consider any maintenance and contingency costs to keep it simple.

If you use the service accommodation model, you could potentially rent out individual rooms as they are all en-suites so that the guests will share only the communal areas like the kitchen. Let's say each room can be rented for £100 per night.

You could potentially be making a maximum of £9000/pcm

£100 (rental per night) * 3 rooms * 30 days in a month.

Obviously, your property won't have a 100% occupancy rate - meaning, you will have voids. So to protect your downside, you want to ensure the deal works at a 50% occupancy rate, which means that the property you control is empty only 15 days a month. If the numbers still work, then you have a good chance to make profits.

Let's say you agree to rent this property with the property owner for £1500/pcm, and you estimate total running costs of £1000/pcm. So, your total monthly costs are around £2.500/pcm.

Assuming this property is let only 15 days per month, you need (£2500/15) £167 per night to cover all your costs - This is called break even. Beyond this point, you start making profits.

Rent-to-Rent Service Accommodation Deal Breakdown:

- Agreed Rent £1500

- Running Costs £1000

- £2500 (Total Costs) / 15 (50% Occupancy) = £167

- Occupancy Rate 50% (half month: 15 days)

- Average costs per night to break even at a 50% occupancy rate is £167

Now, things become interesting when from your market research, you find that the average occupancy rate in your area is 70%, and an en-suite goes on average for £169.

So, if you multiply £169 * 21 days (70% Occupancy Rate) * 3 rooms = £10.647

Normally, you would rent the entire property but because you have all en-suites (every room as its own toilet) you could potentially rent it out by room with the service accommodation model.

You can find your potential average net profits by subtracting your potential average profits minus your total expenses.

£10647 - £2500 = £8147 potential average monthly profits.

Now, let's look at the same property using the HMO business model. The figures will look different because tenants tend to stay on longer tenancy agreements, so you don't have high expenses like service accommodation. Also, we will run the numbers on an annual basis because it's easier to estimate costs and profits when you have long tenancies in place.

Rent-to-Rent House Of Multiple Occupation Deal Breakdown:

- Agreed Annual Rent (1500 *12) £18.000

- Running Costs (500*12) £6.000

- Total Annual Costs £24.000

- Average monthly rent per room (based on your market research) £700/pcm

- Total Annual Revenue £700 * 3 = £ 2100 * 12month = £25.200

- Total Annual Profits (before voids) £25.200 (revenue) - £ 24.000 (expenses) = £1200

- Total Net Annual Profits £1200/12 * 10.5 = £1050

- Annual Voids (1.5 months per year)

- Average Net Monthly Profits (After Voids) £1050 / 12 (months) = £87.5

At first glance, this deal wouldn't stack up because you don't have enough profit margins. However, if we transform the two receptions into rentable rooms, now, you have five rooms to rent. The rent you pay to the property owner is the same, but now your revenues are much higher.

- Total Annual Revenue (Potential Max Rent Collected) £700 *12 months * 5 rooms = £42.000

- Total Annual Costs (£700 * 12) = £8.400

- Net Max Annual Total Profits £42.000 (Revenue) - £8.400 (Costs) = £33.600

- Average Monthly Profits (Before Voids) (£33.600/ 12) = £2800 / pcm

- Net Annual Profits (Including Voids) = £2800 * 10.5= £29.400

- Average Net Monthly Profits (Including Voids) £2450

As you can see, the service accommodation model can be more lucrative than the HMO; however, profitability is not the only metric to consider when choosing your Rent-to-Rent model. Both have pros and cons, and having clarity on your goals, what is working in your area, and the property suitability can guide you to choose the best model for your specific situation.

Is Rent-to-Rent a Profitable Business in the UK?

Rent-to-Rent can be a very lucrative business in the UK because of the strong demand in the rental sector and the new "staycation" trend where Brits spend their holidays in the UK rather than abroad.

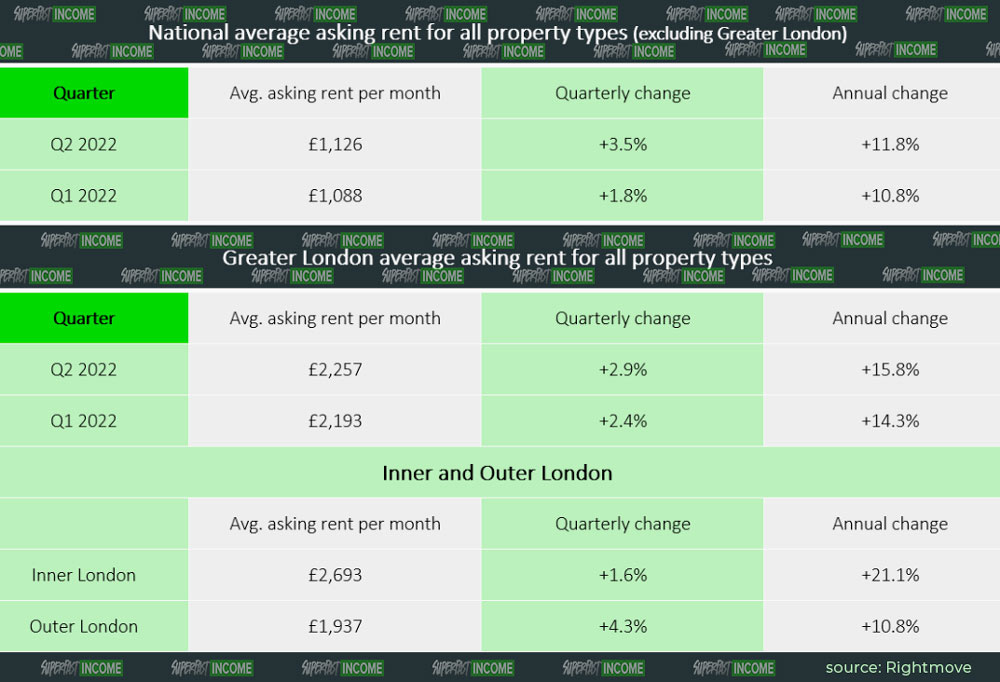

Rightmove and Zoopla, two of the biggest property portals in the UK, reported that asking rents in the UK are up 11% annually (2022). With inflation at an all-time high and a recession on the horizon, we can expect more people to live in shared accommodations and the cost of renting to go up, making the current market conditions very favourable to the Rent-to-Rent business model.

Is Rent-to-Rent a Risky Business In The UK?

Generally, the Rent-to-Rent business model can expose you to more significant risks than an average letting agency because you guarantee the Rent to the property owner for three to five years and may incur an upfront investment to "dress up" the property.

So, when you finally sign the contract for your Rent-to-Rent property, you may have to bring the property up to standard and invest in a cosmetic refurbishment and some furniture. As a rule of thumb, your maximum initial investment in the property should not exceed six months' profits (use a conservative estimate).

If you expect to generate £1000 net monthly profits from this property, don't invest more than £6000 to bring it up to standard. You want to use this figure to break even and start making profits after six months, if not earlier.

What If You Cannot Find Tenants For Your Rent-to-Rent Property?

I am sure you are wondering about this eventuality. What happens if you cannot find tenants after you sign a three or five years guaranteed rent agreement where you guarantee the rent to the landlord no matter what? Everyone new to this game wondering the same because not being able to fulfil your promise to the property owner is a big deal.

However, in your agreement, you must always have a break clause to protect your company if you find that your market research was wrong, the market changed, or if something unpredictable happens. No matter what could be the reason, having the right break clause in your contract can make all the difference in the world for your Rent-to-Rent business.

A break clause allows you or the property owner to specify the length of notice and the terms to end the contract without penalties. You can decide who can exercise it, when and under which circumstances.

Some Rent-to-Rent operators like to have an option to terminate the contract after three months. So, if you have tried everything to fill this property with tenants and you failed because apparently there is no demand for your property, then you can use the break clause to give back the property to the landlord without penalties.

Alternatively, you could have a break clause that allows you to give notice three months in advance at any point of the tenancy, offering more flexibility as you never know when and if the market conditions will change.

As you can see, the terms can vary depending on your negotiation with the property owner and the upfront investment you are making in the property. Why the upfront investment is an important variable? Because you don't want to give the landlord a chance to get back his property before you recover your investment and ideally make some money.

If you know that you will break even after six months, then a break clause at three months where the landlord, for any reason, can get back his property won't work for you because you need at least six months to get your money back.

So, How Much Can I Lose If a Rent-to-Rent Deal Goes Wrong?

With an average deal, you may lose between three and ten thousand pounds if it's going wrong. Not great, but not financially devastating. Below you can find a simplified list of the main expenses when you take on a new rent-to-rent property.

What Are The Costs of Establishing a Rent-to-Rent Business In The UK?

Starting any business requires an initial investment, often known as "startup cost". I put together a short list with everything you need to establish and run a compliant Rent-to-Rent business in the UK.

However, you don't need to wait to incorporate your company to begin speaking to landlords and visiting real estate agencies. If you are someone that needs everything before starting anything, I suggest to read Ready,Fire,Aim - This book will improve your mindset!

Forming Your Company

If you are serious about your Rent-to-Rent business, you need to incorporate your company and treat it as a proper business. To do so, you could ask an accountant or go to Companies Made Simple and set it up yourself. This could cost you anything between £12 and £250 depending if you open it yourself or through an accountant.

Accountant and Bookkeeper

As with any business, you will have ongoing costs, and the accountant is one of them. If you are lucky enough to find a good accountancy firm, they could save you money and potentially become an investment rather than a cost. Try to find an accountancy firm specialising in property. If they understand your strategy, they can provide better advice.

Initially, you may no need a bookkeeper, but as your business grows, I suggest you get one because it can save you time and frustration. This activity is time-consuming, and you can find someone to help you for a very reasonable price, starting at £15/hour. They may charge you up to 5 hours per month to manage a small account. So, around £75/pm

Insurance

Every business in the UK is required to have professional and indemnity insurance. The price will vary depending on your specific situation, the policy terms and the broker. You can find brokers online, request a quote on Companies Made Simple, or compare more than 12 business insurers on Money Super Market. The insurances can vary between £120 up to £450

Property Redress Scheme

Another requirement if you want to run a Rent-to-Rent business is to be part of a Property Redress Scheme. In the UK, we have two bodies, The Property Ombudsman and the PRS (Property Redress Scheme). Personally, I am with the PRS because it's more convenient for me, and they seem to do the same things, so I went with the cheaper one. Be part of the PRS starts at £135 (Plus VAT).

Website

Having an online presence and a website is important in any business. Still, I found it especially important in Rent-to-Rent because it will help you position yourself in the market as more established and professional. I found that sending my link to the landlords after an initial conversation makes me stand out from the crowd - especially when they receive so many offers and calls from people trying to do what I do.

Today anyone can create a website, but it takes time. My suggestion is to find someone in your network or use platforms like Fiverr, Upwork, etc... and outsource this part as soon as possible so you can focus on finding Rent-to-Rent deals and growing your business. A simple, decent one-page website could cost you anything between £500 and £2000

Local Landline Number

Today you can rent a local landline number for as little as £2 per month (Plus VAT).

Why would you do that? It's because when you advertise your business in your "goldmine area" (the area you are targeting to find your rent-to-rent property deals), you want to present yourself as the trusted local authority, and you also want to look professional. So, your goldmine area may not be where you live and having a local number will increase the sense of familiarity and trust with your potential clients.

Also, you don't want to put your personal mobile number on your website and your flyers. And, you don't want to receive calls on your landline in the middle of the night. That's why you want to rent a local landline number just for your property business.

There are so many options available today. I personally use TTNC because it has a very good starting price, and you pay as little as £0.025/min to forward the calls to a UK landline.

TTNC simply redirects the calls from the local number that you are renting from them to any number you want. So, you don't need to buy a new mobile phone. You can change the number to divert your calls at any time and even add multiple numbers depending on the days of the week and the hours of the day.

Using a service like TTNC is also very useful when you scale your team and have someone else answering the inbound calls for you. With TTNC, you can also access easy-to-understand stats about your call activities in case you want to track and analyse them to improve your marketing campaigns.